Overview of the Position of Chinese Lighting Companies in the Global LED Lighting Market

Industry Overview

LED lighting, or Light Emitting Diode lighting, is a type of solid-state lighting technology. It uses solid semiconductor chips as the light-emitting material. When carriers recombine within the semiconductor, excess energy is released as photons, producing red, yellow, blue, or green light. By applying the principle of additive color mixing and adding phosphors, LEDs can emit any color of light.

LED lighting can be classified based on luminous intensity into three categories:

- Standard Brightness LEDs: Used primarily for indicators in various instruments or small character and numeric displays.

- High-Brightness LEDs: Employed in specialized lighting areas such as full-color displays, automotive headlights, special work lighting, and military applications.

- Ultra-High-Brightness LEDs: Widely used in general lighting applications for both civilian and industrial purposes.

Industry Market Development Overview

The widespread adoption of LED lighting was initially driven by government policies, focusing early on applications like evacuation indicator lights, streetlights, and landscape lighting. As LED technology matured and prices decreased, LEDs began to be used in indoor functional lighting. Currently, LED lighting is gradually replacing traditional incandescent bulbs and is becoming the primary lighting source, with major applications in residential and commercial lighting.

With the growing global awareness of energy conservation and environmental protection, LED lighting, known for its low energy consumption, long lifespan, and high brightness, has become one of the green, energy-efficient industries strongly promoted by governments and related enterprises. Especially in the 21st century, with accelerated industrialization and urbanization, energy and environmental pollution issues have become more severe, leading to rapid development of LEDs due to their eco-friendly characteristics.

According to the International Energy Agency, global carbon emissions reached 36.3 billion tons in 2021, a record high. Against this backdrop, achieving peak carbon emissions and carbon neutrality has become an international consensus. For instance, China aims to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 through measures like carbon reduction. In 2020, global electricity consumption for lighting was about 2,900 TWH, accounting for approximately 16.5% of total global electricity generation. Energy savings in the lighting industry will play a crucial role in achieving carbon reduction goals. Compared to traditional light sources, LEDs offer high energy efficiency, safety, stability, and intelligent control, making them a key driver in reducing carbon emissions in the lighting sector. Consequently, there is an international push to accelerate the adoption of LED lighting.

Under the support of China’s Ministry of Science and Technology and the "863" Program, the development of semiconductor lighting was first proposed in June 2003. With continuous advancements in LED chip technology and processes, the luminous efficiency, technical performance, and product quality of Chinese LED lighting products have significantly improved. Additionally, the increasing number of related enterprises and investments in the industry, along with upgrades in manufacturing technology and economies of scale, have further boosted production efficiency. Leveraging these advantages, China has now undertaken key aspects of the LED lighting industry chain development and manufacturing, becoming a major player in the global LED lighting industry.

Industry Data Analysis

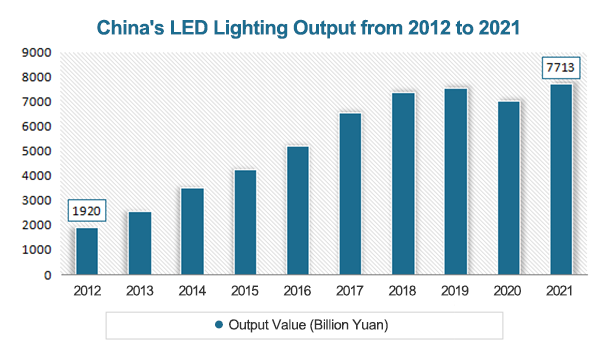

In recent years, China's LED lighting market has continued to develop. Although there was a decline in output value in 2020 due to the impact of the COVID-19 pandemic and a global macroeconomic downturn, effective pandemic control measures in China led to a recovery in the LED lighting industry in 2021, achieving positive growth. Benefiting from the strong economic rebound in 2021 and the emergence of new markets, supported by China's manufacturing advantages in LED lighting, the industry has entered a new growth cycle. Data shows that from 2012 to 2021, the total output value of China's LED lighting industry increased from 192 billion yuan to 771.3 billion yuan.

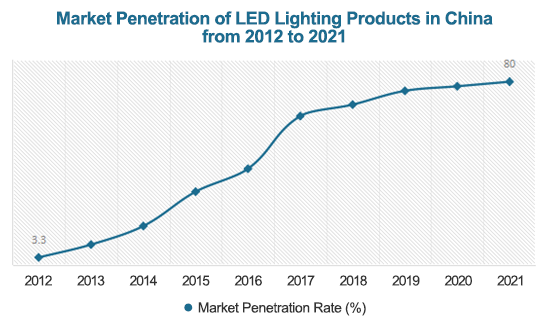

As China intensifies its promotion of energy-saving lighting projects, LED lighting products, representing energy-efficient solutions, have become widely used due to technological advancements, leading to a significant increase in domestic penetration. Data shows that from 2012 to 2021, the penetration rate of LED lighting in China rose from 3.3% to 80%.

Currently, domestic LED lighting manufacturers have become a crucial part of the global LED lighting industry, playing key roles in the development and manufacturing of LED lighting products. Companies such as Shenzhen Lianyu Optoelectronics Co., Ltd., Lida Technology Co., Ltd., and Zhejiang Sunshine Lighting Electric Group Co., Ltd. represent domestic lighting enterprises that have gained international recognition due to their technological advantages, design capabilities, production, and quality control. They mainly operate under the ODM model, providing LED lighting products that meet the increasingly complex needs of brand owners.

Overall, the current market concentration in China's LED lighting industry is low, and the industry is relatively fragmented. Data shows that the market concentration in China's LED industry is low, with CR3, CR5, and CR7 all below 10% and showing a downward trend. This indicates that there are many competitors in the LED industry, with leading companies having little market control and intense competition.

According to the "China LED Lighting Industry Development Trends Analysis and Investment Prospect Forecast Report (2023-2030)" published by the Guanyan Report Network, notable companies in the current Chinese LED lighting market include Shenzhen Lianyu Optoelectronics Co., Ltd. (Lianyu), Lida Technology Co., Ltd. (Lida), Xiamen Kinglight Electronics Co., Ltd. (Kinglight), Hengdian Group Densun Lighting Co., Ltd. (Densun Lighting), Zhejiang Sunshine Lighting Electric Group Co., Ltd. (Sunshine Lighting), Jiangsu Hengtai Lighting Co., Ltd. (Hengtai Lighting), Hangzhou Huapu Yongming Optoelectronics Co., Ltd. (Huapu Yongming), and Opple Lighting Co., Ltd. (Opple Lighting).