The shipment volume of smart lighting devices is expected to reach nearly 40 million units in 2024

Definition and Development of the Smart Lighting Industry

Smart lighting refers to a distributed control system composed of technologies such as IoT, wired and wireless communication, power line communication, embedded intelligent information processing, and energy-saving control. It enables intelligent control of lighting devices, allowing adjustments to brightness, color temperature, and features like timed control and scene control. Smart lighting aims to create a comfortable lighting environment tailored to human needs in specific scenarios.

Development Stages

1990-2011:

LED lighting gradually replaced traditional lighting (e.g., fluorescent lamps).Foreign smart lighting system manufacturers invested in domestic factories, accelerating the growth of local smart lighting companies.

After 2005, wired technology gained popularity, leading to widespread use of commercial smart LED lighting. However, residential applications were limited to luxury villas, with notable brands like Lutron (USA) leading the market.

2012-2019:

Transition from smart single products to comprehensive lighting solutions.Experience-focused offline stores began to emerge.

The concept of "no main light" gained popularity, combining smart technology to create intelligent no-main-light products, primarily used in hotels, malls, and restaurants.

2020 to Present:

Businesses actively promote whole-house smart (no-main-light) lighting solutions. Offline smart experience stores have proliferated. Applications have expanded from commercial to residential use, further integrating smart lighting into everyday life.

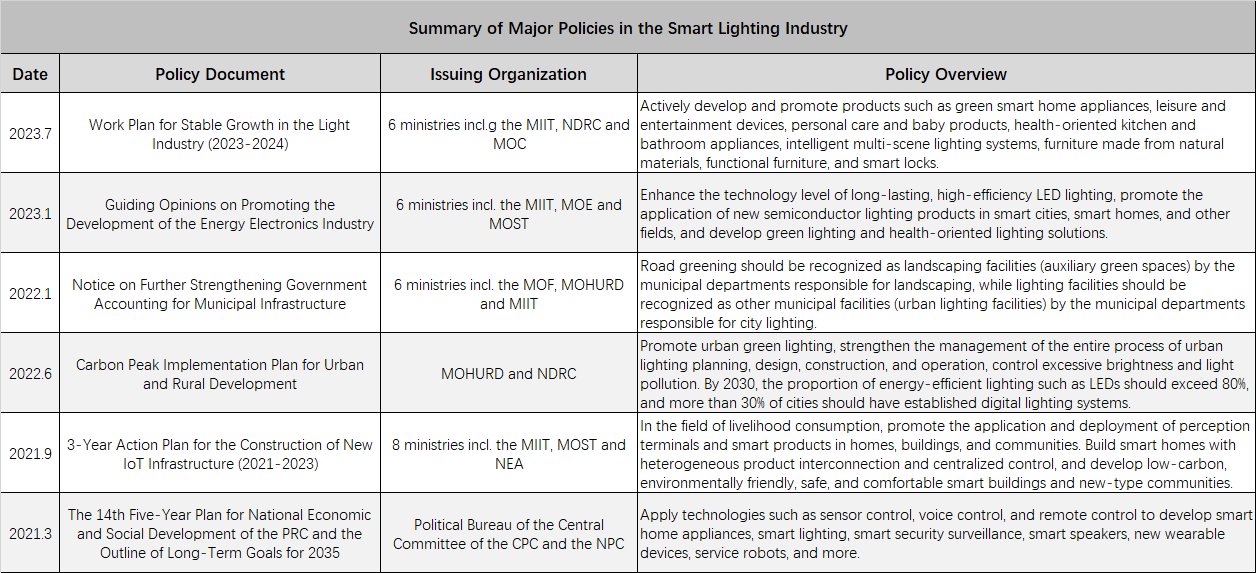

Key Policies Supporting the Smart Lighting Industry

In recent years, the government has introduced a series of plans and policies for the smart lighting industry, including the *Work Plan for Stabilizing Growth in the Light Industry (2023-2024)*, the *Guidelines for Promoting the Development of the Energy Electronics Industry* issued by six ministries including the Ministry of Industry and Information Technology, and the *Notice on Further Strengthening Government Accounting for Municipal Infrastructure*. These initiatives provide a clear and promising market outlook for the smart lighting sector, creating a favorable production and operational environment for enterprises.

Analysis of the Current State of the Smart Lighting Industry

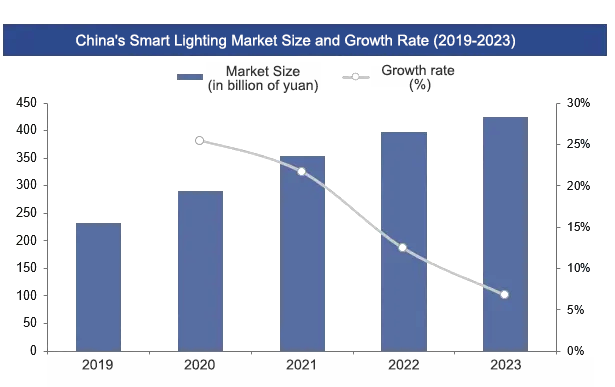

1. Market Size

Since the 1990s, overseas smart lighting manufacturers have invested in building production facilities in China. Entering the 21st century, domestic smart lighting companies have emerged rapidly. With the rapid advancement of technology and growing environmental awareness, smart lighting systems have transitioned from a conceptual stage to reality, gradually becoming an indispensable part of modern life and industrial applications. Data shows that the domestic smart lighting market in 2023 reached approximately 42.5 billion RMB, representing a year-on-year growth of 6.78%.

2. Shipment Volume

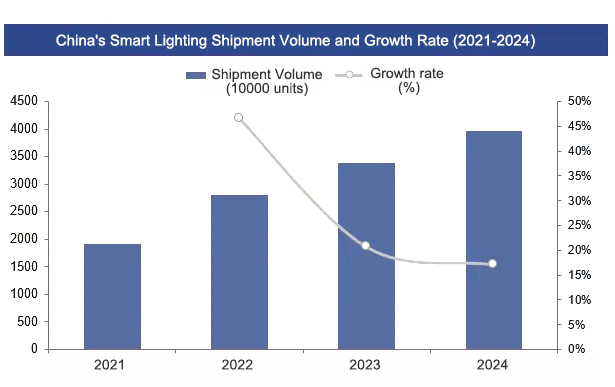

Thanks to the booming development of downstream applications in smart homes, commercial lighting, urban lighting, industrial lighting, and other sectors, as well as the positive impact of the further popularization of health lighting concepts, the smart lighting market in China has flourished, with shipment volumes rapidly increasing. According to IDC data, China's smart lighting shipments grew from 19.1 million units in 2021 to 33.79 million units in 2023, with a compound annual growth rate (CAGR) of 33% from 2021 to 2023. It is expected that the shipment volume of smart lighting devices will reach nearly 40 million units in 2024.

3. Segmented Market Structure

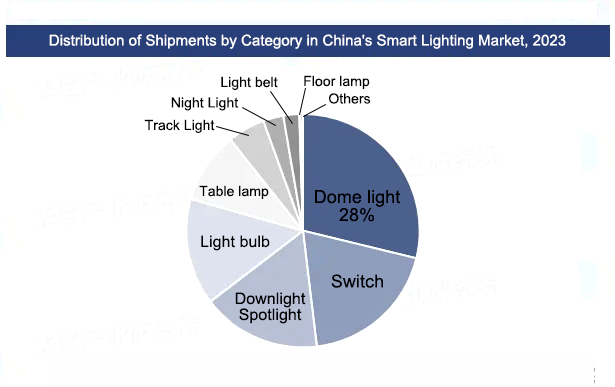

In recent years, with the rapid development of the national economy, particularly the booming real estate industry, the domestic smart lighting industry has also experienced rapid growth. There is a wide variety of smart lighting products available, including ceiling lights, switches, downlights/spotlights, bulbs, table lamps, and more. Data shows that in 2023, ceiling lights, switches, and downlights/spotlights ranked in the top three in terms of domestic smart lighting shipments, with a total shipment share of 64.6%.

Industry Chain Analysis of the Smart Lighting Sector

1. Industry Chain Structure

The smart lighting industry chain is long and covers a wide range of application scenarios, involving companies from various sectors including hardware, software, cloud platforms, IoT, and solution providers. Factors such as cost reduction in upstream core raw materials, integrated solutions in the midstream, and expansion of B2B applications in the downstream continue to drive market growth.

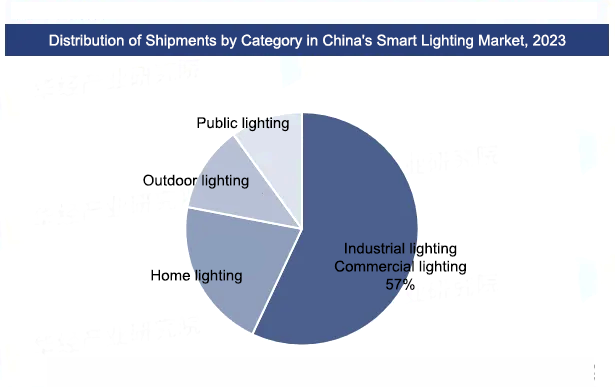

In the upstream, there are raw material suppliers, capital, and technology-intensive areas needed for smart lighting product production. Midstream participants include various smart lighting solution providers. In the downstream, domestic smart lighting applications are currently dominated by commercial uses.

2. Downstream Application Areas

The downstream applications of smart lighting include four major sectors: industrial and commercial lighting, residential and home lighting, outdoor lighting, and public lighting. Industrial and commercial lighting is the largest application area for the smart lighting industry, accounting for about 57%. This is followed by residential lighting and outdoor lighting, with public lighting having the smallest share.

Industry Chain Analysis of the Smart Lighting Sector

The market growth points for smart lighting are mainly concentrated in the residential and commercial sectors. As consumer acceptance of smart homes continues to rise, the penetration of smart lighting in home lighting is expected to further increase, particularly among the younger generation, who are more inclined to use technology to enhance their quality of life. In addition, the demand for smart lighting systems in commercial spaces, especially in retail, hotels, and offices, is also growing, driven by the need to improve the ambiance, increase work efficiency, and save energy.

Businesses should target these market growth points by launching more tailored products and services. For example, designing smart lighting solutions that match different home styles, offering personalized scene-setting options, and enhancing user experience through seamless integration with home ecosystems. In the commercial sector, companies can provide smart lighting systems that create differentiated lighting effects and adapt to different functional areas, such as tunable white office lighting and ambient hotel lighting.

The application potential of smart lighting systems in industrial and public sectors is also worth exploring. With the rise of concepts like smart factories and smart mining, industrial lighting companies will increase R&D investments to promote the application of smart lighting in industrial environments. Public lighting, such as streetlights, parks, and squares, can be managed more efficiently through smart lighting systems, reducing energy consumption while improving the urban nighttime environment. Companies can collaborate with governments and public facility management organizations to promote the application of smart lighting in these areas and provide integrated solutions.

Technological advancements such as 5G, the Internet of Things (IoT), and artificial intelligence will continue to drive innovation in the smart lighting market. Companies should invest in the development of new technologies, such as optimizing wireless communication technologies to achieve more stable and energy-efficient connections, or introducing AI algorithms to make smart lighting systems more precise in predicting and adapting to user needs. Additionally, health lighting and environmentally friendly development are also key focus areas for the future, such as developing eye-care lamps that reduce visual fatigue or utilizing light's connection to circadian rhythms to support human health.