Analysis of the Development Status and Trends of China's Outdoor Lighting Industry

Overview of Outdoor Lighting

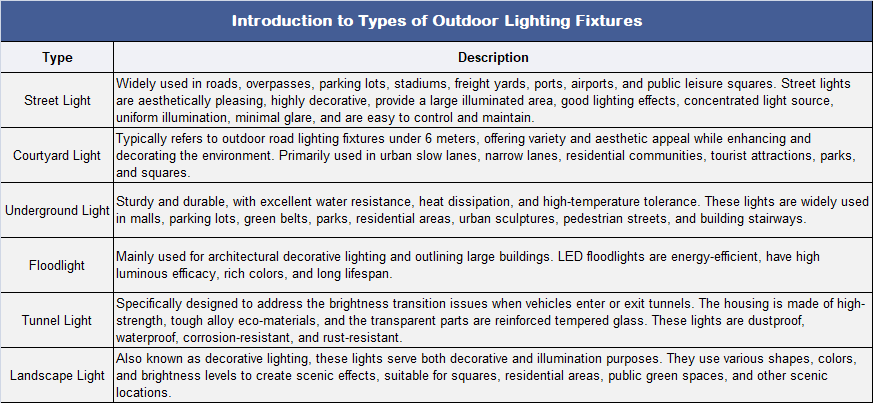

Outdoor lighting refers to lighting systems used outside indoor spaces, primarily to meet the visual requirements of outdoor activities and achieve decorative effects. Outdoor lighting is characterized by high power, strong brightness, large size, long lifespan, and low maintenance costs. It is typically used in environments with complex conditions, covers large areas, and requires high stability.

As a result, outdoor lighting systems have stringent demands for heat dissipation, dustproofing, and waterproofing. Traditionally, incandescent lamps, halogen lamps, and high-pressure sodium lamps were used in outdoor lighting, making it a key area for LED replacement, although the adoption of LEDs has been relatively slow.

Industry Development Background

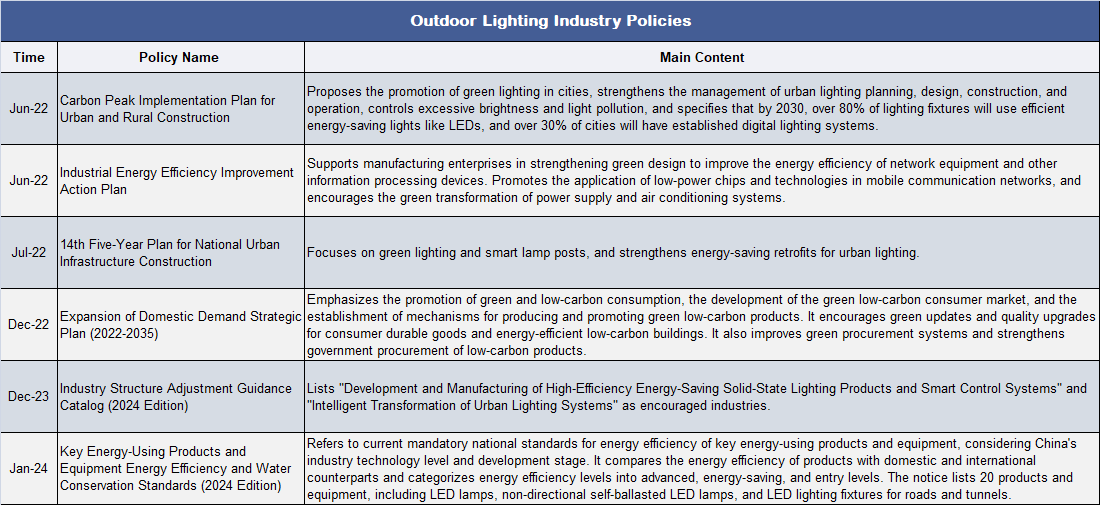

Outdoor lighting is a sub-sector within the LED lighting industry. As a next-generation light source and green lighting solution, LED lighting is widely applied in areas such as green lighting, health lighting, smart cities, and smart homes. In recent years, the government has introduced a series of supportive policies to promote the development of the LED lighting industry. These include the "14th Five-Year Plan for National Urban Infrastructure Construction" and the "Carbon Peak Implementation Plan for Urban and Rural Construction," among others.

These policies emphasize the promotion of energy-efficient, green, and high-performance light sources in urban, residential, and educational settings, contributing to the achievement of carbon peak and carbon neutrality goals. These efforts have greatly boosted confidence in the industry's development and created a favorable policy environment for growth.

Industry Chain

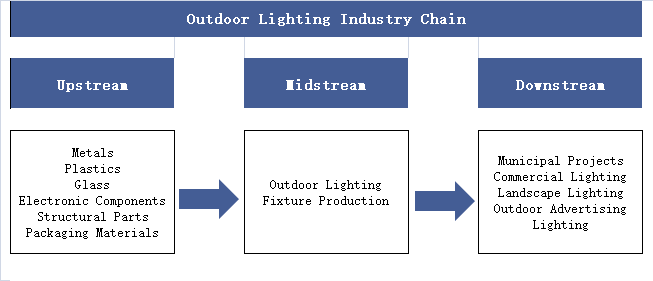

The production of outdoor lighting fixtures requires a variety of raw materials, including but not limited to metals (such as copper, aluminum alloys, and steel), plastics, glass, electronic components (such as LED chips and controller chips), structural components (such as lamp holders, heat sinks, reflectors, etc.), and packaging materials. The quality of these raw materials directly impacts the durability, aesthetics, and safety of the lighting fixtures.

Midstream companies primarily focus on processing raw materials and components from upstream suppliers into finished outdoor lighting products. The primary application areas for these products include municipal projects, commercial lighting, landscape lighting, and outdoor advertising lighting.

Current Development Status of the Outdoor Lighting Industry

1. Global LED Outdoor Lighting Market Size

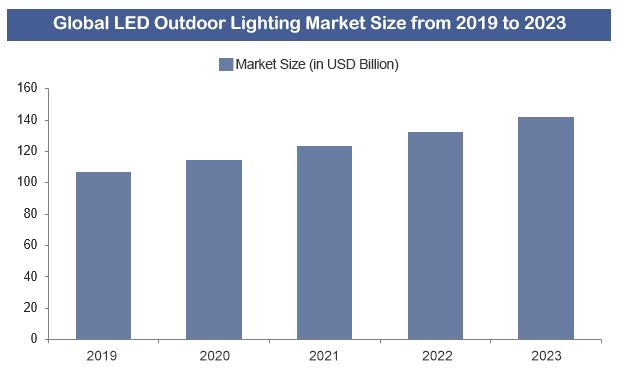

Outdoor lighting is characterized by complex usage environments, large lighting areas, and high stability requirements. It requires superior performance in heat dissipation, dust resistance, and waterproofing. Traditionally, incandescent lamps, halogen lamps, and high-pressure sodium lamps have been used, making outdoor lighting a key area for LED replacements. However, the replacement process has been relatively slow.

On a global scale, the LED outdoor lighting market reached a size of USD 14.18 billion in 2023, marking a year-on-year growth of 7.26%.

2. LED Lighting Market Size in China

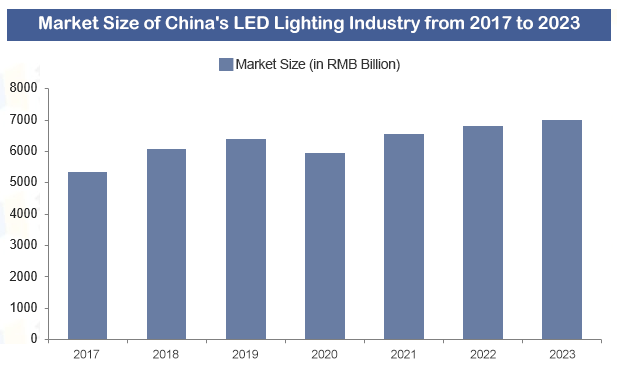

With the gradual increase in LED penetration in recent years, LEDs have become the mainstream light source in the lighting industry, and China has become one of the largest consumers of LED products. Between 2017 and 2023, the Chinese LED industry market size initially saw continuous growth, followed by fluctuations at a high level.

As the pandemic normalized and the pace of resumption of work and production accelerated, the growth rate of the LED lighting market slowed, but it continued to show an upward trend. The market size grew from 534.3 billion CNY to 701.2 billion CNY, with a CAGR (Compound Annual Growth Rate) of approximately 4.63%.

3. Outdoor Lighting Market Size in China

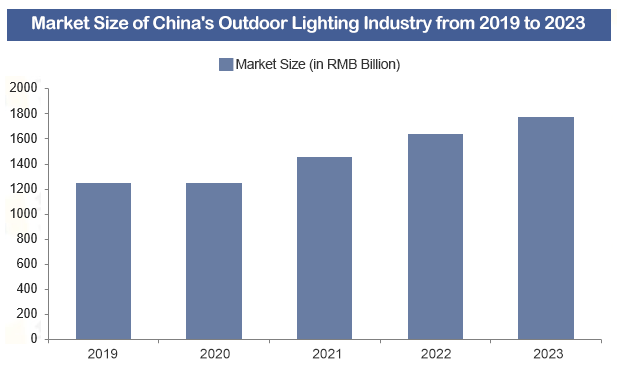

With the strengthening of China’s comprehensive national power and the deepening of urbanization, urban lighting projects have been promoted nationwide, and outdoor lighting fixtures have gradually transitioned to a role that combines both functionality and decoration.

From 2019 to 2023, the size of China’s outdoor lighting market grew from 124.76 billion CNY to 177.57 billion CNY, with a CAGR of approximately 9.23%.

4. Market Share of Outdoor Lighting

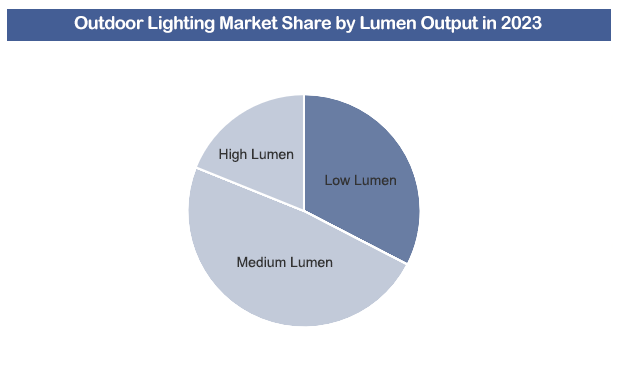

Outdoor lighting fixtures with medium to low lumen output dominate the market and are expected to continue growing in the coming years. These medium to low lumen lighting fixtures are mainly used for functional and ambient lighting, such as task lighting, security lighting, and area lighting.

They meet the basic brightness needs for outdoor activities such as walking, working, and entertainment.

Related Report: The Huajing Industry Research Institute has released the "2024-2030 China Outdoor Lighting Industry Market Panorama Monitoring and Investment Outlook Report."

Outdoor Lighting Industry Competitive Landscape

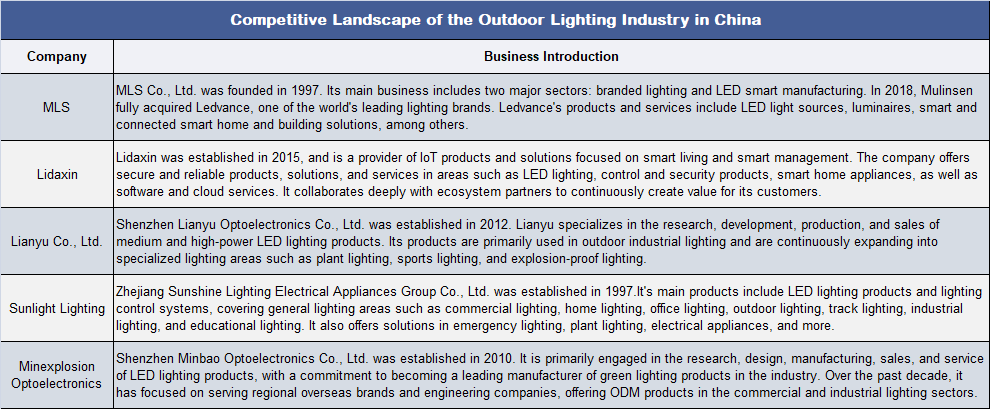

The global LED outdoor lighting industry has established a complete industrial chain, with the global lighting market primarily distributed across Asia, North America, and Europe. Asia, represented by China, has become the manufacturing hub for the global LED outdoor lighting industry.

The region mainly participates in global competition by offering ODM (Original Design Manufacturing) and OEM (Original Equipment Manufacturing) services.

Outdoor Lighting Industry Development Trends

1. Intelligent Development

With the continuous advancement of technologies such as the Internet of Things (IoT), sensors, and artificial intelligence (AI), outdoor lighting is becoming increasingly intelligent. Smart lighting systems can automatically adjust brightness and color temperature based on factors such as ambient light and pedestrian traffic, thereby achieving energy savings while enhancing user experience. Additionally, smart control systems enable remote monitoring, fault alerts, and other functions, improving operational efficiency. This trend toward intelligence will drive the outdoor lighting industry to evolve in a more efficient, convenient, and smart direction.

2. Energy Efficiency and Environmental Protection

As global focus on environmental protection and sustainable development increases, energy efficiency and environmental friendliness have become key development directions for the outdoor lighting industry. Energy-efficient light sources, such as LEDs, offer advantages like high efficiency, energy savings, and eco-friendliness, and will see broader adoption. At the same time, lighting companies are continually researching new eco-friendly materials and technologies, aiming to reduce energy consumption and environmental pollution. In the future, green lighting products will become the mainstream in the outdoor lighting market.

3. Personalized Customization

As consumer demand for lighting continues to grow, personalized customization will become a key trend in the outdoor lighting industry. Different scenarios and needs require tailored lighting solutions, which means outdoor lighting products will become more diverse and individualized. Companies will be able to offer customized lighting products and services based on customer requirements, catering to the unique preferences of their clients.

Technological Innovation and Product Upgrades

Technological innovation is a key driver for the growth of the outdoor lighting industry. In the future, the industry will continue to focus on technological advancements and product upgrades, launching more efficient, smart, and eco-friendly lighting products. At the same time, with the continuous emergence of new materials and technologies, the performance and quality of outdoor lighting products will see further improvements.